Easy Financial Planning for Beginners: The 50-30-20 Rule

Budgeting doesn’t have to be difficult or take up a lot of your day. In actuality, the most straightforward budgeting methods are frequently the best.

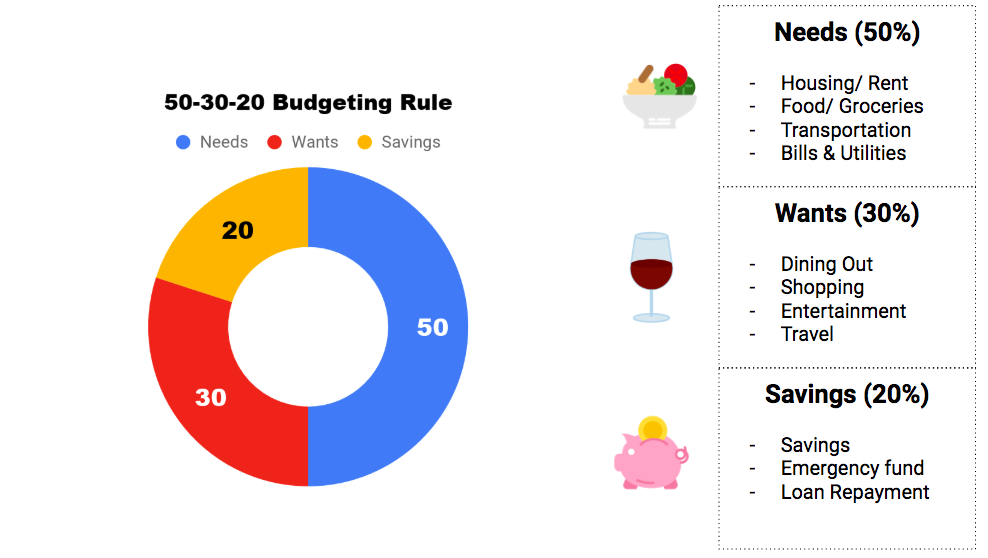

The basic guideline is to distribute after-tax income as follows: 50% for needs, 20% for savings, plus 30% for wants.

The 50/30/20 rule: where did it come from?

The “All Your Worth: The Ultimate Lifetime Money Plan” book from 2005, authored by present US Senator Elizabeth Warren as well as her daughter Amelia Warren Tyagi, is where the 50/30/20 rule first appeared.

Decoding the Rule

In reality, the rule is extremely straightforward. Split your cash on hand into 3 equally sized amounts. 30% of income is spent on wants, 50% on needs, plus 20% is set aside for savings and investments. You will now have established buckets for all things and be working within each bucket’s permitted limitations if you do this. This will help you develop discipline while ensuring that you don’t sacrifice the standard of living or your long-term planning.

About the rule

- This rules is simple to understand, and very logical, designed to make people stive towards their financial aims.

- According to the norm, you should devote up to 50% of your after-tax income to necessities and commitments that are essential to you.

- The remainder should be divided into 30% for anything else you might want, 20% for savings, and 10% each for debt reduction and savings.

The 50/30/20 Rule of Budgeting is as follows

50%: Needs

The expenses you definitely must pay as well as the goods you need to survive are considered needs. These include mortgage or rent payments, auto loans, food expenses, insurance, medical expenses, minimum debt payments, plus utility bills. You absolutely gotta have these. Items which are considered extras, like Netflix, HBO, Starbucks, and dining out, are not included in the “needs” section.

You should only require half of the after-tax income to meet your requirements and commitments. You will need to either reduce your wants or try to downgrade your lifestyle, possibly to a smaller home or more modest vehicle, when you are investing over than that on your requirements. An option might be to commute together in a car, use public transit, or cook more frequently at home.

30%: Wants

Everything you invest money on that isn’t necessary is a want. This includes going out to eat and see a movie, that new handbag, athletic event tickets, trips, the newest electronic device, plus ultra-high-speed Internet. When you boil it down, everything in the “wants” category is optional.

Instead of visiting a gym, you can exercise at home, prepare meals at home, or watch sports on television rather than purchasing tickets to an event.

This category also encompasses the decisions you make when upgrading, like selecting a pricier steak over a cheaper hamburger, purchasing a Mercedes over a Honda, or deciding between viewing TV either using an antenna for no cost or by purchasing cable. Wants are essentially all the little extras you buy to improve your quality of life.

20%: Savings

Lastly, make an effort to set aside 20% of your net income for investments and savings. It involves making IRA contributions to a mutual fund account, stock market investments market, and adding money to emergency savings in some kind of a bank savings account. In case you are laid off or experience an unexpected incident, you should have at least 3 months’ worth of emergency savings on hand.

If emergency funds are ever needed, the emergency fund account should receive priority for allocating new cash. Repaying debt is another use for savings. Whilst minimum payments fall under the “needs” category, any additional payments save money because they lower the principal and accrued interest.

An explanation of how to use the 50/30/20 rule in detail

1. Determine your after-tax income

2. Classify your recent monthly spending

3. Review and tweak your spending to adhere to the 50/30/20 criteria.

4. Use a spreadsheet using the 50/30/20 rule to evaluate

Conclusion

It is simpler for you to make and keep to a monthly budget when you have a defined distribution that you know you will divide among the many spending categories. Based mostly on these principles, one can adjust how much money is allocated to each of the 3 categories as revenue rises.